New Position as Research Group Leader at the Max Planck Institute for the Study of Societies (MPIfG)

From April 2025 onwards, I will be leading a Lise Meitner Research Group on Technology and Sovereignty at the MPIfG.

I am truly excited to work in this exceptional environment and to engage with its remarkable academic community. The research group investigates how socio-economic relations which are reconfigured by articulations of sovereignty manifest in technologies, and how technologies are shaped by political demands of sovereignty and security.

The call for doctoral researchers is closed.

The call for a postdoctoral researcher is here

Webinar at the Center for European Studies at the University of Florida

As part of the “Innovative Europe Series” I will speak about the Geoeconomics of the Digital Euro.

Register here: https://ces.ufl.edu/calendar/

I was recently featured in an article by Financial Times’ “The Banker”. I shared a few thoughts on the new leadership at the Bank for International Settlements (BIS).

Finance and Society

Call for Papers: When finance becomes tech

As part of the editorial team of Finance and Society we invite submissions for a special issue on how financial services are fusing with digital technology and what the broader implications of this are in social, political, and economic terms.

Find the full CfP here: https://www.cambridge.org/core/journals/finance-and-society/announcements/call-for-papers/call-for-papers-when-finance-becomes-tech

Wednesday, 03 July 2024 | 6 pm |

Berlin Social Science Center (WZB)

Reichpietschufer 50, 10785 Berlin

Money as a digital technology

Lecture as part of the lecture series “Making Sense of the Digital Society”, organised by Alexander von Humboldt Institute for Internet and Society (HIIG) and the Federal Agency for Civic Education (bpb)

From contactless payments to mobile wallets and cryptocurrencies, the way we handle money is becoming increasingly digital. As monetary systems fundamentally shape social relationships and the organisation of modern societies, the differing modes of transacting digital money alter these relations. Everyday transactions are processed on platforms provided by Tech Giants instead of banks, raising concerns about data privacy and market dominance. Digital money is increasingly recognised as a technology that can be innovated and enhanced. As a reaction, central banks around the world develop their own new forms of digital money to counter attempts by Tech Giants to issue their own currencies with potentially global reach. Central Bank Digital Currencies, such as the digital euro, link monetary sovereignty to issues of digital autonomy and aim to provide a (public) infrastructure for financial relations in light of increasing geoeconomic tensions.

Analysing money as a technology thus shifts our attention towards new questions: Which relations are technologically enhanced, which are excluded? How is the data generated by digital financial transactions handled and how are they stored? Who has the ability to enable and sanction (international) payment transactions?

Fellowship within the ZEVEDI Young Investigator-Programme

During my Fellowhship from April - Dezember 2024, I will be hosted by Prof. Dr. Ute Tellmann at TU Darmstadt.

More information about my project

and the fellowship can be found here.

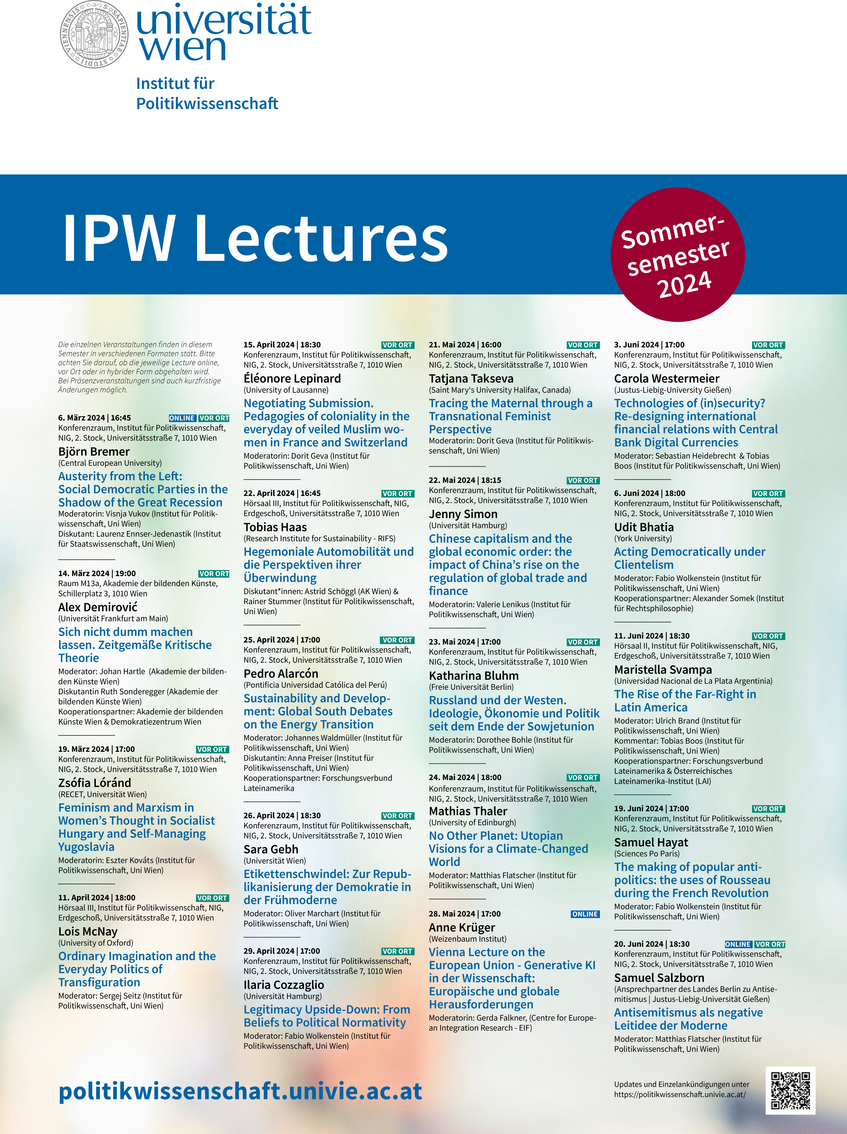

IPW Lecture at University of Vienna

Technologies of (in)security? Re-designing international financial relations with Central Bank Digital Currencies

Very much looking forward to be part of the IPW Lecture Series and to talk about CBDCs and international (in)security at the University of Vienna. Here is the abstract of my talk:

Even before the international sanctions regime imposed against Russia in reaction to their war against Ukraine, international financial relations had become a battleground of geopolitical struggles. Consequently, financial operators such as SWIFT, Visa, and Mastercard are increasingly perceived as political actors rather than neutral networks. As a potential alternative, financial technologies, known as Central Bank Digital Currencies (CBDCs), offer a means to redesign both domestic and international financial relations. The crucial distinction from cryptocurrencies is that CBDCs are developed within the core of the established financial system, by central banks. Currently, over 114 central banks, including the European Central Bank, the Federal Reserve, and the Bank of England, are engaged in CBDC development. China's digital yuan, already in the pilot phase, is often associated with the country's geoeconomic aspirations. Hence, the development of digital central bank currencies transcends mere payment systems; it embodies technologies that evolve amidst uncertain future expectations, shaping and being shaped by them. CBDCs have the potential to foster international cooperation or lead to fragmentation. The talk will discuss the intricate interplay of technology, security, and finance, and propose ways to conceptualize their governance.

Some impression from Blockchain Horizons Conference in Darmstadt where I presented insights from our project on ‘Money as Data’ and discussed future directions of payments and money with other panelists.

New Research Project on Money as Data

Researcher: Marek Jessen

Funded by the Centre Responsible Digitality (ZEVEDI)

Abstract: Every day, we use different means of digital payments. Whether payments are made by debit card, credit card or via app - all these payment methods have one feature in common: they leave traces. Transactions data is most valuable as it allows several conclusions to be drawn about personal life and actual behaviour. Data-driven platforms whose business model is based on the monetisation of data and payment service providers share an interest in the use of financial transaction data. Despite the sensitivity of transaction data, little is yet known about its commercial use. In particular, the question on which technologies enable which data usage has not yet been addressed.

This is the starting point of the ad-hoc project. It aims to provide an overview of the use of transaction data by different financial actors. Based on case studies, criteria for the responsible processing and usage of transaction data are to be developed. To this end, a classification scheme is being developed to show in a ‘data protection scoring’ what impact the various payment types have on data protection.

The question of how financial actors use transaction data is also closely linked to questions of regulation and has strong normative implications: In the course of a regulatory-induced market liberalisation, EU regulations have significantly facilitated access to transaction data and thus simplified market access for FinTechs and BigTechs. The project thus combines regulatory matters with the analysis of technological design and normative implications. With its analysis of how transaction data is currently used commercially, the project develops the basis for discussions on how transaction data could be used in the future.

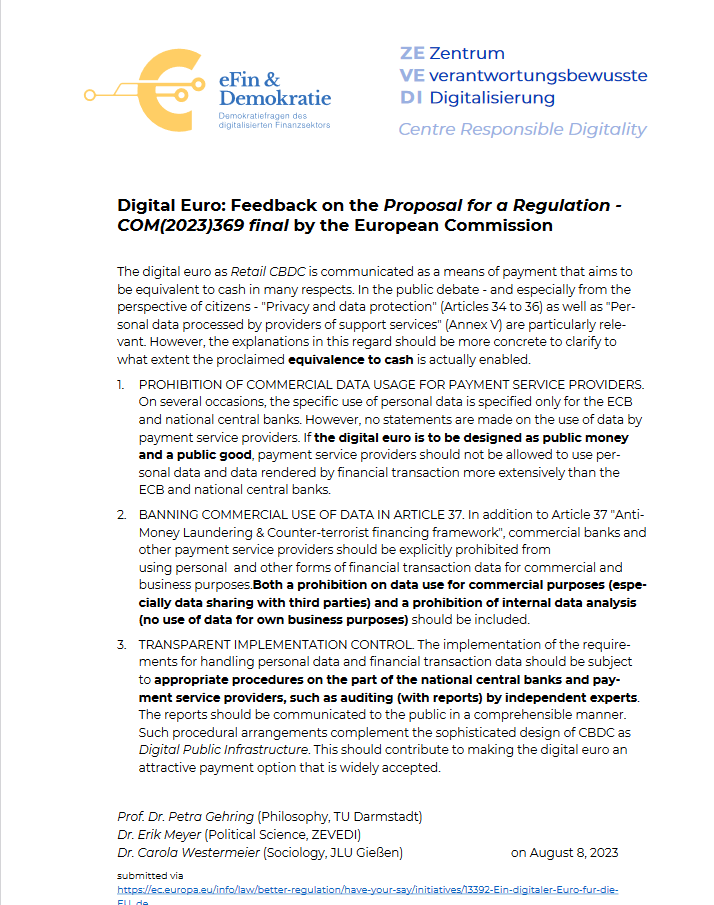

Special kind of science comminication.

Together with Prof. Petra Gehring & Dr. Erik Meyer we provided feedback on the Proposal for a Regulation of the Digital Euro.

Our central remark: transactional data should not be used for commercial purposes by private payment actors. We also demand more transparency in its implementation.

What a week…

Between June 5 and 9 I attended three different conferences: re:publica in Berlin,

a discussion on the digital euro with representatives of the Europea Central Bank, the banking industry and the European Commission in Brussels,

and the Crisis Capitalism Conference in Hanover.

some impression from re:publica (left), panel on the digital euro (middle), Crisis Capitalism conference (right)

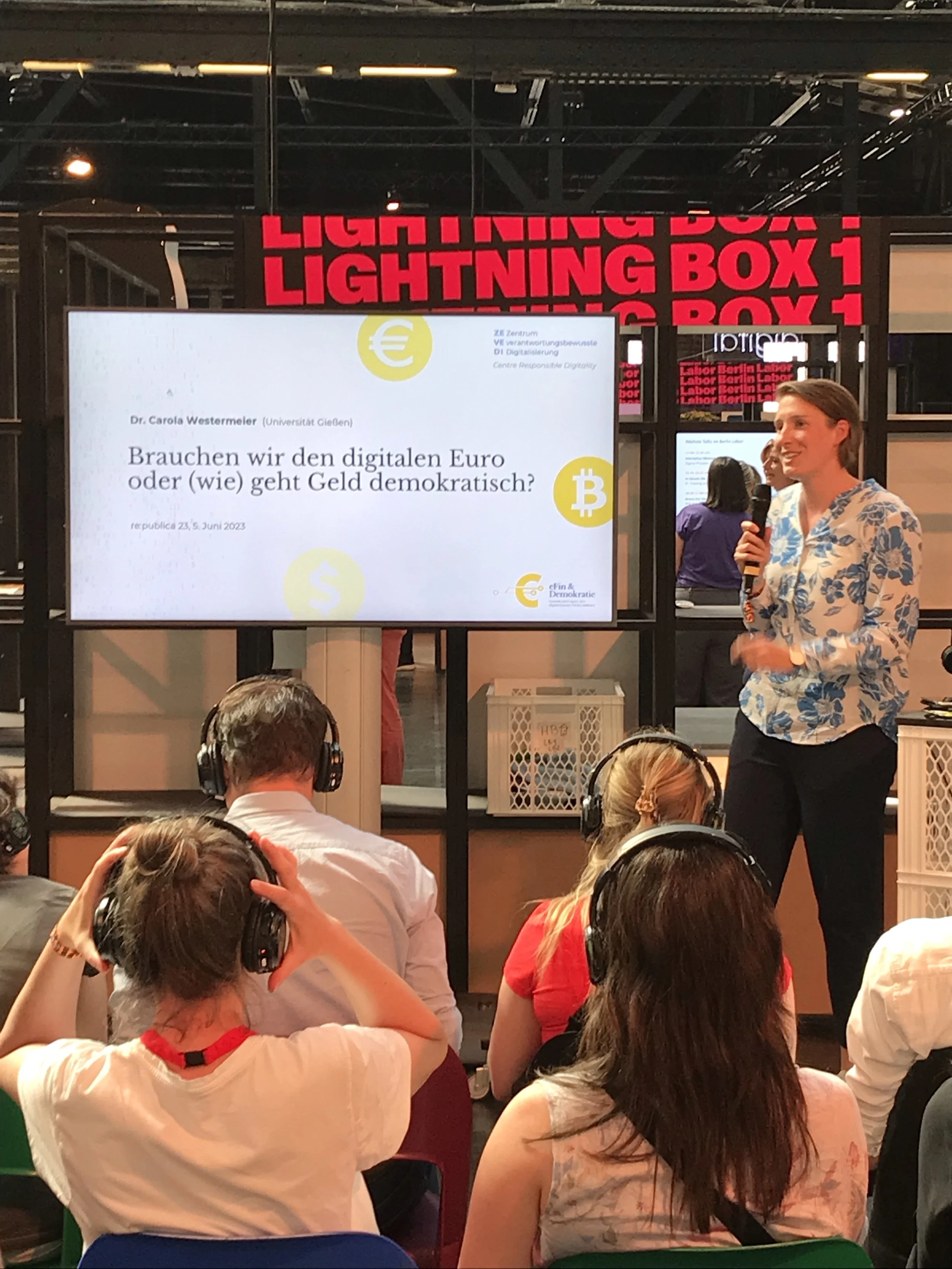

Video of re:publica talk on the digital euro

re:publica has published the video of my talk on the digital euro on youtube. The talk is in German but youtube offers automatically enabled subtitles in various languages.

The talk is a cooperation with the discourse project eFin & Democracy – Democracy issues of the digitalised financial sector

Do we need a digital euro or how can money be more democratic? Talk at re:publica 2023 Berlin

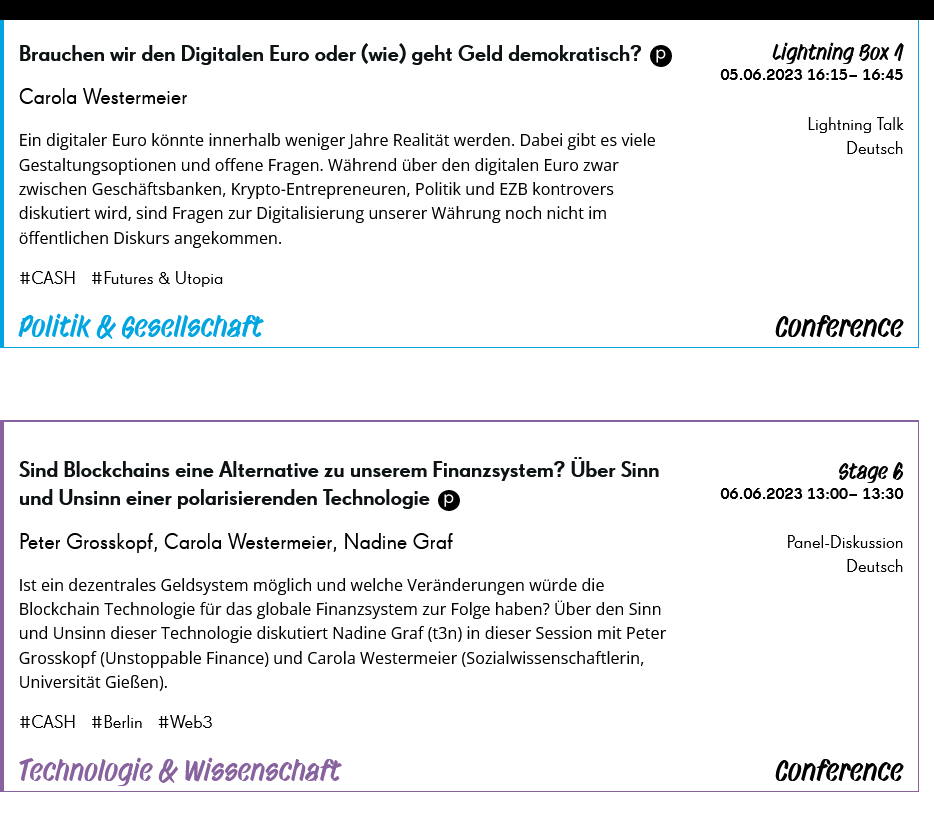

Re:Publica 2023

This year’s Re:Publica has CASH as its motto.

In a talk about the Digital Euro I will discuss if an how money can be democratic. This talk is inspired by my engagement in and organised by the discourse project eFin & Democracy – Democracy issues of the digitalised financial sector at the centre for responsible digitality (ZEVEDI).

I will also be part of panel on Blockchains as alternatives to the established financial system.

I look forward to an exciting conference with many interesting talks and encounters.

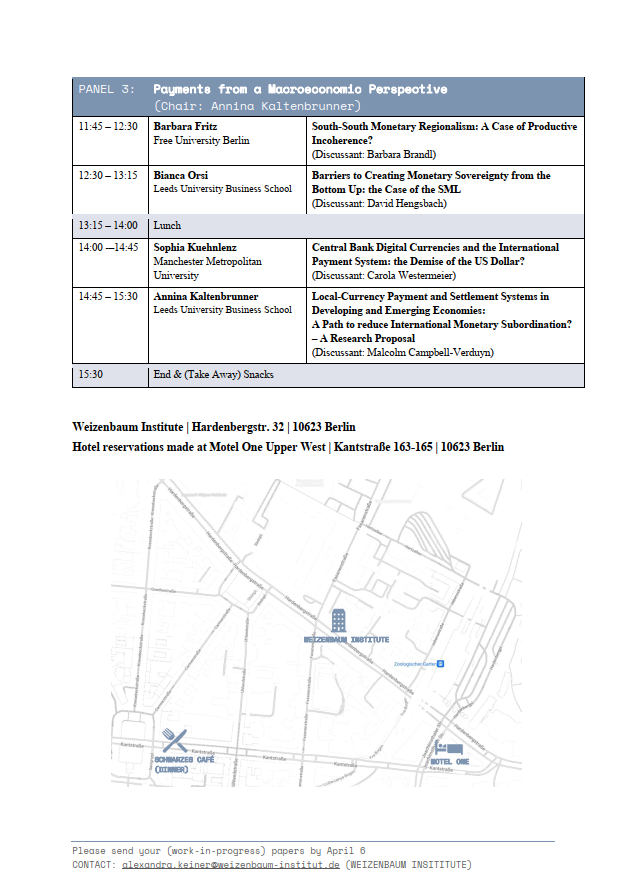

Workshop on Payment Infrastructures and Multidimensional Inequalities

Together with Annina Kaltenbrunner (Leeds), Barbara Brandl (Frankfurt) and Alexandra Keiner (Berlin) I co-organised a workshop on Payment Infrastructures at Weizenbaum Institute Berlin.

Pictures taken by Katharina Stefes, Weizenbaum Institute

Lecture series on ‘Current Avenues in Comperative and International Political Economy’

Together with Johannes Petry I co-organised this series at Goethe University Frankfurt.

For the British International Studies Association I prepared a short summary of my latest article published in the Review of International Studies

It provides some key insights of the article that discusses the Wirecard scandal and explains how Central Bank Digital Currencies have the potential to alter the international architecture and enhance security demands that are currently evolving amidst geopolitical tensions.

Here is a summary of the article: From follow the money towards infrastructural geopolitics: How financial technologies enable (changing) security regimes | BISA

The full paper at: https://t.co/H8vjZydD5j

Find a summary of my latest article on the page of the British International Studies Association

SASE Mini-Conference

Financial Infrastructures: From Colonial Trajectories to Global Digital Transformations

Co-organized with Barbara Brandl and Malcolm Campbell-Verduyn

-

Conceiving Financial Infrastructures

The first day presentations by Nathan, Coombs, Jürgen Schraten, David Pinzur (in action below), Timo Walter, Toels Krarup, Xiaochuan Tong, Gary Robinson, Sabine Dörry, David Hengsbach, Nikiforos Panourgias & Dionysios Karavidas, Paula Haufe and Annika Stenstrom

Twitter thread with all presentation of day 1 here

-

Digitizing and De)Centralizing Financial Infrastructures

The second day had presentations by Edemilson Paraná, Ludovico Rella, Mianzhi Francis Cao, Moritz Huetten, Valeria Ferrari (on the picture below), Andreas Langenohl, Chris Muellerleile, Lilith Dieterich. Koray Caliskan chaired one planel

Twitter thread with all presentations of day 2 here

-

Panel on on Post-Colonial Financial Infrastructures

The final panel was chaired by Marieke de Goede and had presentations by Valérie L'Heureux & Marie Langevin, Manuel Wirth, Bianca Orsi and Cybele Atme (on the picture below)

Find Full Program here:

Podcasts on Sanctions and Politics of Money

Together with my colleague Barbara Brandl I discussed the recent sanctions against Russia, the role of financial infrastructures and SWIFT and the role of cryptocurrencies to circumvent the sanctions

(in German) Click hereThe public radio Bayern 2 features my comments in an episode of IQ - Wissenschaft und Forschung on the effectiveness of econmic sanctions, Nov 2022 (in German). Click here

New Research Project

Financial Infastructures and geoeconomic Security

As part of the Collaborative Research Centre SFB/Transregio 139 ‘Dynamics of Security’ at the universities Giessen and Marburg

Prof Andreas Langenohl and Dr Carola Westermeier

Funding period: 2022-2025

(Short Abstract)

The project investigates interdependencies between securing financial transactions and articulations of geopolitical security. It analyses currents projects and politics of that aim to secure financial transactions and those that aim to build alternatives to the current payment system wich is perceived to be US-dominated.

The project investigates technology-driven companies that offer financial transactions which are emerging in the European Union, China and Russia. These companies often interact with governments and other authorities to offer and expand their services. The project also inquires the role of central banks as providers and regulators of payment services. However, this ‘traditional’ position of central banks is challenged and central banks also find themselves cooperating with political institutions to maintain and expand their role in the field of payments.

These projects and politics need to be contextualized as part of broader geopolitical perceptions of (financial) security that problematize the US-hegemony within financial and payment systems.

German abstract below and the CfA for two 2PhD Positions —>

2 PhD Positions in

the field of Security Studies and/or Social Studies of Finance

Join our project Financial Infrastructures and Geoeconomic Security at Justus Liebig University Giessen and Phillips University Marburg.

One sub-project investigates firms of the digital economy that offer services in the field of international financial transactions and are increasingly based in the European Union, in Russia and in China, and entertain relationships with governments and administrations in these areas.

The other sub-project analyses the changing role of central banks as traditional providers of payment and transaction infrastructures, which in their turn maintain close relationships with political and government institutions.

The deadline for applications is already January 4th, 2022 - if this poses a substantial problem or if you have any questions, do not hesitate to get in touch (carola.westermeier@staff.uni-marburg.de or westermeier@soz.uni-frankfurt.de).

Find the extended vacancy here

Neues Forschungsprojekt

Finanzinfrastrukturen und geoökonomische Sicherheit

Teilprojekt des gemeinsamen Sonderforschungsbereichs/Transregio 138 „Dynamiken der Sicherheit. Formen der Versicherheitlichung in historischer Perspektive“ der Universitäten Gießen und Marburg.

Projektleitung: Prof. Andreas Langenohl und Dr. Carola Westermeier

Laufzeit: Januar 2022 -Dezember 2025

(kurzes Abstract)

Das Projekt widmet sich gegenwärtigen Wechselwirkungen zwischen der Sicherung finanzökonomischer Transaktionen und der Artikulation geopolitischer Sicherheitsanliegen. Das Projekt untersucht gegenwärtige Projekte und Politiken der Sicherung von Finanztransaktionen, in denen sich neben den USA als globalem Finanzzentrum und dem Dollar als Weltwährung weitere Akteure und Institutionen zur Geltung bringen. Damit geht es über die in der Forschung mittlerweile gut rekonstruierten Zusammenhänge im Nexus von Finanzmarkt und politischer Sicherheit in Bezug auf die USA und Großbritannien hinaus.

Untersucht werden insbesondere Unternehmen der Digitalwirtschaft, die internationale Transaktionsdienste anbieten, die nicht nur in den USA, sondern auch von der Europäischen Union, sowie von Russland und China aus aktiv werden und hierbei häufig Kooperationen mit dortigen Regierungen und Behörden anbieten. Zudem nimmt das Projekt Banken und Zentralbanken als traditionelle Zahlungsdienstleister in den Blick, die mittlerweile ihre Vorherrschaft auf diesem Gebiet bedroht sehen und ebenfalls in enger Kooperation mit politischen Institutionen stehen. Diese Projekte und Politiken stehen im Kontext geopolitischer Sicherheits- und Bedrohungswahrnehmungen, die insbesondere eine als hegemonial wahrgenommene Dominanz von US-basierten Finanztransaktions- und Zahlungssystemen als zunehmend problematisch betrachten.

Für die Mitarbeit in diesem Projekt sind zwei Doktorand*innenstellen ausgeschrieben

Mini-Conference

at SASE 2022 in Amsterdam

Togehter with of Dr. Barbara Brandl and Malcolm Campbell I am organising a mini-conference on financial infrastructures as part of the early July 2022 meeting of the Society for the Advancement of Socio-Economics (SASE) at the University of Amsterdam.

Submit a paper or panel to mini-conference TH06 - Financial Infrastructures: From Colonial Trajectories to Global Digital Transformations

International Studies Association

Annual Conference, Nashville 2022

Pandemic permitting, this might be the first international (hybrid) conference where I hope to meet many international friends and colleagues. I will present two papers and discuss a few more.This trip will be funded by German Academic Exhange Service (DAAD)

Conference Autumn 2021

DGS // German Sociological Association

Chairing a Panel on Financial Infrastructures together with Barbara Brandl.

EISA PEC 2021.

Chairing Roundtable on Taking the Trouble? STS, IR and care for/in a common world with Rocco Bellanova

Session description here

RGS-IBG Annual International Conference 2021

Presenting ‘Trails of Money? Following (suspicious) transactions in the realm of financial security.’ In Panel 'On Methods of Thing-Following'

DVPW // German Political Science Association

Security and Power in the World Economy - a Critical Exchange on Weaponized Interdependence

Panelists: Hans-Jürgen Bieling, Henry Farrell, Susanne Lütz. Abraham L. Newman, Elisabeth

Winter

Moderation: Daniel Mertens and Thomas

+

Innen- und Außenpolitik, Wirtschaft- und Sicherheitspolitik zusammen denken

Organised by Sophia Hoffmann and Kai Koddenbrock

EISA PEC 2021

Materalized Hegemonies – The (new?) Geo-Politics of Financial Infrastructures with Marieke de Goede

Panel on IPE Meets STS

PREGOV Workshop

Hamburg, 17-18

September

Towards Transdisciplinary Perspectives on Algorithmic Prediction & Decision-Making

Financial Surveillance & Experimentation

This webinar discusses how banks experiment with digital technologies to detect suspicious transactions. Banks are legally obliged to conduct customer research, monitor transactions and to report transactions that are possibly related to money laundering or terrorist financing to the authorities. Because of the millions of transactions that flow daily through their databases, banks are reliant on digital technologies that filter and monitor their customers. This webinar explores how financial surveillance is characterised by processes of continuous experimentation.

Lecture Series on Financial Infrastructures

Together with Barbara Brandl (Frankfurt) I organize a digital lecture series during the summer term of 2021. Some of the talks will be in English. Let me know if you want to join us. Guests are very welcome.

We are also preparing a panel on the same topic at the Congress of the German Sociological Association(GSA)and the Austrian Sociological Association(ASA)2021. See our Call for Papers below.

Call for Abstracts

Ad Hoc Group on Financial Infrastructures at the Congress of the German Sociological Association(GSA)and the Austrian Sociological Association(ASA)2021

Carola Westermeier & Barbara Brandl

While large parts of everydaylife were restricted as an important part in the fight against COVID19, financial infrastructures proved themselves as the invisible backbone of to keep the economy alive. Financial infrastructures guaranteed a minimum of economic stability as they ensured that government payments could substitute the lack of consumption. While the mobility of commodities and persons was highly restricted, financial infrastructures sustained the global circulation of money and debt, through contactless payments, the disbursement of government aid, the granting of loans, as well as through monetary policy. Within the latter, the European Central Bank Euro responded to the crisis with the staggering amount of over 1.8 Billion in their Pandemic Emergency Purchase Programme –(PEPP). Despite their decisive role in maintaining economic exchange, they are rarely acknowledged within public discussion on ‘criticality’.

More than a decade ago, the financial sector was the source of political and societal insecurity within the crises of 2008ff. but during the global pandemic its role seemed to have changed completely. State actors consciously use the ‘infrastructural power’ of the financial marketsto enforce their support measures (Braun, 2018). Financial infrastructures though are not neutral structures that can easily be used by political actors for their ambitions, but they also constitute and maintain societal power relations (Krarup, 2019). While payments, currencies and debts are hotly debated topics within economic sociology, international political economy and heterodox economics, the infrastructures that allow their circulation are largely neglected (Bernards, Campbell-Verduyn, 2019; Petry,2019). In this “Ad hoc Gruppe” we want to bundle differing perspectives on financial infrastructures to strengthen the sociological debate on (financial) infrastructures. We are especially interested in the following questions:

How are financial infrastructures transformed by digital technologiessuch as Blockchain? Does the meaning of money change, if it is exchanged in peer-to-peer networks? Which kind of actors are able to appropriate these new technologies? The traditional intermediaries such as banks or new players such as technology driven companies?

How inclusive or exclusiveare the existing financial infrastructures? How do they pertain (historical) social inequalities, such as colonial power relations (de Goede 2020)?

How do financial infrastructures come to matter beyond the financial sphere? How do they gain importance inother societal fields, such as security or health? In which ways has the pandemic contributed to the articulation of financial infrastructures as ‘critical infrastructure’ (Langenohl 2020)?

Please send your abstract (a maximum of 2,400 characters incl. spaces) by April 18th to Carola Westermeier (Carola.Westermeier@sowi.uni-giessen.de) and Barbara Brandl (brandl@soz.uni-frankfurt.de).